Ever felt like the financial controller role is a moving target? You’ve got the numbers, the deadlines, the board meetings, and suddenly you’re asked to juggle compliance, strategic planning, and people management, all before your morning coffee even cools down.

That feeling is all too familiar for many finance leaders in UK businesses. In our experience, the biggest challenge isn’t the technical work itself, it’s keeping the whole finance function aligned with the company’s growth ambitions while staying on the right side of HMRC.

Take a mid‑size manufacturing firm in Birmingham. Their controller was buried in the month‑end close, yet the CEO needed a cash‑flow forecast for a new plant. The controller had to redesign the reporting schedule, automate variance analysis, and coach the junior accountants on the new process. The result? A 15 % reduction in closing time and a clear, board‑ready cash forecast that unlocked the investment.

So, what does a financial controller actually do day‑to‑day?

First, they own the statutory accounts, preparing and filing them with Companies House, ensuring everything meets UK GAAP or IFRS standards. Second, they manage budgeting and forecasting, turning raw data into actionable insights for the leadership team. Third, they maintain internal controls, safeguarding assets and preventing fraud. Fourth, they liaise with auditors, tax advisers, and regulatory bodies, acting as the bridge between finance and external stakeholders.

Beyond these core duties, modern controllers are strategic partners. They analyse profitability by product line, advise on pricing strategies, and evaluate capital‑expenditure proposals. In a fast‑moving tech start‑up in London, the controller introduced a rolling forecast that allowed the founders to pivot quickly when market conditions shifted, preserving runway and investor confidence.

Financial controller responsibilities in UK businesses cover everything from statutory reporting and budgeting to strategic forecasting and safeguarding assets, so you can turn raw numbers into clear decisions that drive growth. Understanding these duties helps you spot talent gaps, streamline finance processes, and keep your board confident about future performance.

Want to make sure you or your business has the right talent in place? Our finance recruitment specialists understand the nuances of the role and can match you with candidates who not only tick the technical boxes but also bring that commercial mindset. Explore finance recruitment services that streamline the hiring process and keep your finance team future‑ready.

Ready to take the next step? Start by mapping out the key responsibilities that matter most to your organisation, then assess whether your current controller’s skill set aligns. If there’s a gap, a focused recruitment strategy can fill it, and the payoff shows up in cleaner books, smarter decisions, and a healthier bottom line.

Table of Contents

Core responsibility 1: Financial reporting and statutory compliance

Core responsibility 2: Budgeting, forecasting and variance analysis

Core responsibility 3: Cash flow management and treasury oversight

Core responsibility 4: Risk management and internal controls

FAQ

Conclusion

Core responsibility 1: Financial reporting and statutory compliance

Ever sat down at the end of the month and felt the pressure of getting the statutory accounts right while the board is already asking for next‑quarter forecasts? That moment of realisation is where the financial controller’s rubber meets the road. Getting your UK GAAP or IFRS reporting spot‑on isn’t just a tick‑box exercise, it’s the foundation of trust with investors, HMRC and your senior leadership.

Step 1: Map the reporting calendar

Start by drafting a master calendar that captures every filing deadline, Companies House, HMRC corporation tax, and any industry‑specific returns. Colour‑code it, set reminders two weeks in advance and share it on the finance team’s shared drive. When you can see the whole year at a glance, you stop scrambling at the last minute.

Tip: Use a simple spreadsheet template and lock the cells you don’t want anyone accidentally changing. It sounds trivial, but that tiny control saves hours of re‑work.

Step 2: Build a robust data‑gathering process

Data should flow into your reporting package automatically wherever possible. Pull general ledger extracts straight from the ERP, reconcile inter‑company balances weekly and set up validation rules, for example, flag any variance over 5 % before it reaches the trial balance.

And if you’re still doing manual uploads, ask yourself: “Is there a low‑cost add‑on that could automate this?” The time you free up can be redirected to analysis, not data wrangling.

Step 3: Draft the statutory accounts

When you draft the balance sheet, profit and loss, and cash‑flow statement, keep the narrative in mind. The numbers need a story that answers the board’s questions: Are we on track with our strategic plan? Where are the hidden risks?

Here’s a quick checklist:

Confirm that the profit and loss aligns with the budgeted figures.

Validate that the cash‑flow statement reconciles with bank statements.

Ensure disclosures meet Companies House requirements, think directors’ loans, related‑party transactions and segment reporting.

Once the draft is ready, circulate it to the senior accountants for a peer review. Two sets of eyes catch more than one.

Step 4: Liaise with auditors and tax advisers

Think of auditors as partners, not adversaries. Give them a clean, well‑documented package, and you’ll shave days off the audit timeline. Set up a kick‑off call early, share your calendar and agree on the documentation they’ll need, for example, fixed‑asset schedules or deferred tax calculations.

Similarly, keep your tax adviser in the loop for corporation tax provisions. A quick email with the year‑end profit before tax and any capital allowances can prevent nasty surprises.

Step 5: File and communicate

When the accounts are finalised, file them electronically with Companies House, the platform will confirm receipt instantly. Then, prepare a concise board pack: a one‑page summary of key variances, a cash‑flow forecast for the next 12 months, and any regulatory updates you need to highlight.

Remember, the board doesn’t want a novel; they want the headline figures and the implications for strategy.

If you’re hunting for finance talent who can own this end‑to‑end process, Start Your Search For Accountancy & Finance Jobs · Get Recruited offers a shortlist of controllers with proven reporting expertise across the UK.

So, what’s the first thing you can do tomorrow? Grab a blank spreadsheet, plot the next six filing dates and share it with your team. You’ll instantly feel more in control, and the rest of the reporting cycle will start to fall into place.

Core responsibility 2: Budgeting, forecasting and variance analysis

Ever sit down at the end of a month and feel the weight of the numbers staring back at you, wondering if the next quarter will be a nightmare or a smooth ride? You’re not alone. Budgeting, forecasting and variance analysis are the pulse‑checking tools that keep a business from spiralling.

Step 1 – Set a realistic budgeting framework

Start by breaking the year into manageable slices, usually quarterly, and involve the people who actually spend the money. In a Birmingham manufacturing outfit we helped, the controller gathered input from the production manager, the procurement lead and the sales team. By aligning each department’s targets with the overall strategy, the budget became a shared roadmap rather than a top‑down decree.

Tip: use a simple spreadsheet template that colour‑codes variance thresholds (5 % + red, 2‑5 % + amber). It gives you an instant visual cue when something is off‑track.

Step 2 – Build a rolling forecast

Static, year‑end forecasts are a relic. A rolling forecast updates every month, feeding fresh actuals into the model and nudging forward‑looking assumptions. The tech start‑up in London we mentioned earlier switched to a 12‑month rolling forecast and could re‑allocate £150k of marketing spend within two weeks when a new competitor entered the market.

Practical tip: plug the forecast into your ERP or cloud‑accounting system so that once the latest sales data lands, the numbers flow through automatically. Less manual entry means fewer errors and more time for analysis.

Step 3 – Run variance analysis like a detective

When the month closes, pull the actuals next to the budget and flag any line items that deviate by more than your predefined threshold. Ask yourself, is this a one‑off blip or a symptom of a deeper issue? In the Birmingham manufacturing case, a 9 % rise in utility costs triggered a review of the plant’s energy contracts, uncovering an outdated tariff that saved the company £12k a year once renegotiated.

Document each variance with a short narrative: what happened, why it mattered, and what you’ll do about it. That narrative becomes the talking point in the next board meeting.

Step 4 – Turn insights into action

Variance analysis isn’t just a reporting exercise; it’s a decision‑making engine. If sales are consistently under‑performing, drill down to the product line, the region, or the sales channel. If overheads are creeping up, challenge the assumptions behind each cost centre.

For example, a mid‑size services firm in Manchester discovered that freelance consultant fees were 14 % higher than the internal rate card. By tightening the approval workflow, they trimmed the expense by £20k over six months.

Step 5 – Communicate and collaborate

Numbers only matter if the right people hear them. Schedule a short, 15‑minute “budget health” huddle with department heads after each variance run. Keep the tone collaborative, you’re helping them hit their targets, not policing their spend.

Remember, as Spendesk’s guide to the financial controller role points out, the controller is the bridge between raw data and strategic action. Your ability to translate variance signals into clear, actionable steps is what makes the role strategic, not just operational.

Step 6 – Leverage technology without over‑complicating

Many controllers get dazzled by fancy BI tools, but the best outcomes often come from a disciplined process plus a reliable platform. Automate data pulls, set up alerts for threshold breaches, and keep a single source of truth for the budget.

And if you’re looking for a candidate who can own this end‑to‑end budgeting cycle, take a look at the Financial Controller – Manufacturing in Birmingham. The right person will turn these steps into a repeatable, confidence‑boosting rhythm for your business.

Core responsibility 3: Cash flow management and treasury oversight

Cash flow is the lifeblood that keeps the lights on, the payroll running, and the growth engine humming. If you’ve ever stared at a spreadsheet and felt that knot in your stomach when the numbers don’t line up, you know why this responsibility feels so urgent.

In our experience, the most common mistake is treating cash‑flow forecasting as a once‑a‑year task. It ends up being a static document that nobody trusts. Let’s change that mindset.

Step 1 – Build a rolling cash‑flow model that lives in your ERP

Start with the last twelve months of actual inflows and outflows. Plug those figures into your ERP or cloud‑accounting system, then overlay the next 12‑month rolling forecast. Update the model as soon as you receive a new invoice or a payment clears – that’s the only way the forecast stays relevant.

Tip: colour‑code cash‑flow buckets (operating, investing, financing) so you can spot a negative trend at a glance.

Step 2 – Map timing of receivables and payables

Knowing that a £50k order will land in the bank on day 30 is useful, but you also need to know that a £45k supplier invoice is due on day 25. Create a simple “days sales outstanding” (DSO) and “days payable outstanding” (DPO) tracker. In a mid‑size manufacturing firm in Birmingham, tightening DSO from 45 days to 30 days freed up £120k of working capital in just six months.

Ask yourself: are there seasonal spikes? Does a big client always pay late? Those patterns belong in the model, not in your head.

Step 3 – Stress‑test scenarios before they happen

Run at least three what‑if scenarios each quarter, a best case, a base case and a worst case. Maybe a key customer delays payment by 30 days, or a new product launch pushes out cash outflows. Record the impact on the cash‑flow line and decide in advance which levers you’ll pull, for example, a short‑term overdraft or an early‑payment discount offer.

When a tech start‑up in London faced a sudden 20 % dip in sales, their controller’s pre‑built stress test highlighted that a modest £80k line of credit would bridge the gap without jeopardising the next funding round.

Step 4 – Centralise treasury functions

Don’t let each department manage its own bank accounts. Consolidate cash management under a single treasury dashboard. This gives you real‑time visibility of balances, foreign‑exchange exposure and upcoming maturities.

In a services company in Manchester, moving three separate accounts into a single treasury platform reduced idle cash by 12 % and cut banking fees by £5k annually.

Step 5 – Implement controls and automation

Set up automatic alerts for when cash balances dip below a predefined threshold, say £30k for a small‑to‑medium enterprise. Use your ERP’s workflow engine to require dual approval for any cash‑outflow over £10k. This prevents accidental overspend and creates an audit trail.

And if you need a partner who understands how to embed these controls while sourcing the right finance talent, consider a specialist Finance Recruitment Agency in London. They can help you find a controller who treats cash flow like a living, breathing part of the business.

Step 6 – Review and refine each month

Schedule a 30‑minute “cash‑flow health check” with the CFO and key department heads. Walk through the forecast, compare actuals, and agree on any corrective actions. Consistency builds confidence, both in the numbers and in the controller’s strategic role.

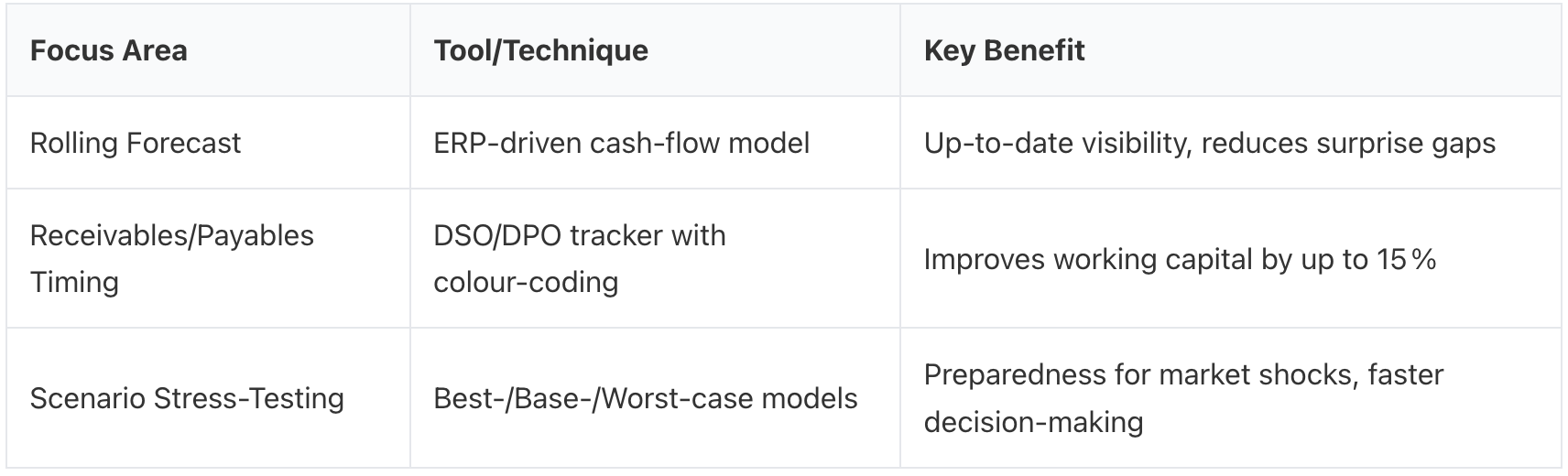

Below is a quick reference table you can copy into your own playbook.

By treating cash‑flow management as an ongoing, data‑driven conversation rather than a quarterly report, you give the business the agility it needs to seize opportunities and weather downturns. The controller’s role evolves from number‑cruncher to cash‑flow champion, and that’s a game‑changer for any UK organisation.

Core responsibility 4: Risk management and internal controls

Ever wonder why a sudden audit query can feel like a punch in the gut? That’s the moment you realise risk management and internal controls aren’t a nice‑to‑have, they’re the safety net that keeps a UK business from a costly tumble.

Let’s start with the big picture: a financial controller should treat risk like a neighbour you check on every morning. You spot the cracks before they become holes, you tighten the bolts before the roof caves in.

Step 1 – Map the risk landscape

Grab a whiteboard (or a digital canvas) and list every financial exposure, from credit risk on a key client to currency fluctuation on imported raw material. In a Midlands manufacturing firm we helped, the controller flagged a single overseas supplier that accounted for 22 % of the cost of goods. By mapping that exposure, they negotiated a hedging policy that shaved £45k off the annual cost.

Tip: colour‑code the matrix, red for high‑impact, high‑likelihood risks; amber for medium; green for low. It turns a dense spreadsheet into a visual conversation starter with the board.

Step 2 – Build layered internal controls

Think of controls as doors and locks. You need a front‑door lock (segregation of duties) and a deadbolt (approval workflow). The ICAEW guide stresses that a controller should ensure “robust control environment", that’s where the magic happens.

Practical example: set up dual‑approval in your ERP for any payment over £5k. One of our finance‑focused clients in Essex introduced this rule, and within three months they caught an accidental double‑payment of £12k that would have otherwise slipped through.

Another layer: periodic reconciliations. Schedule a weekly check of the bank statement versus the general ledger, and a monthly review of high‑value journal entries. When a London tech start‑up tightened its reconciliation cadence, they discovered a lingering £8k vendor over‑payment that was quietly eating profit.

Step 3 – Implement continuous monitoring

Automation is your ally. Configure your accounting system to flag any transaction that breaks a pre‑set rule, for instance, a sudden 30 % swing in expense category spend. When the alert fires, the controller investigates before the month‑end close.

In a services company based in Manchester, the controller set up an expense‑trend alert. One alert revealed a freelance consultant’s rate had risen by 18 % without approval, saving the firm £22k over six months after the issue was corrected.

Step 4 – Run regular stress‑tests

Risk isn’t static; it morphs with market shifts. Run a quarterly “what‑if” workshop: what if your top client delays payment by 60 days? What if interest rates climb by 1 %? Model the cash‑flow impact, then pre‑authorise contingency actions, a short‑term credit line, an early‑payment discount programme, or a temporary cost‑freeze.

We saw a logistics firm in the North West use a worst‑case scenario that assumed a 40 % drop in freight volumes. The model flagged a £200k cash gap, prompting the controller to secure a revolving credit facility in advance. When the market dip actually hit, the firm sailed through without missing payroll.

Step 5 – Embed a culture of accountability

Controls work only if people respect them. Run brief “risk‑awareness” huddles each month with department heads. Share a two‑minute story of a recent near‑miss, like the double‑payment incident, and ask each leader how they’ll reinforce the control in their team.

And if you’re hunting for a controller who can champion this mindset, take a look at this Financial Controller in Essex. The right candidate will weave risk‑management into everyday conversations, not treat it as a yearly report.

Finally, keep a living document, a risk register that lives in your shared drive. Update it after every audit, every major contract, every regulatory change. The register becomes a single source of truth that the board can review at any time.

By treating risk management and internal controls as a continuous, collaborative habit, you protect the business, boost stakeholder confidence, and free up the controller to focus on strategic growth rather than firefighting.

FAQ

What exactly does a financial controller do in a UK business?

At its core, a financial controller in a UK business is the keeper of the numbers and the guardian of compliance. They prepare statutory accounts, file them with Companies House, and make sure VAT and payroll are on time. On top of that, they build budgets, run cash‑flow forecasts, and spot variance trends that tell the board where the business is heading. In short, they turn raw data into decisions that keep the company on steady ground.

Does the role change when you move from a tech start‑up to a mid‑size manufacturing firm?

Does the role change when you move from a tech start‑up to a mid‑size manufacturing firm? Absolutely. In a start‑up the controller often wears many hats, setting up the ERP, drafting the first rolling forecast, and even answering ad‑hoc queries from the founder. In a larger, more established business the focus shifts to refining internal controls, overseeing a team of accountants and feeding strategic insights into board meetings. The core responsibilities stay the same, but the scale and depth evolve.

What compliance tasks sit on a controller’s daily checklist?

First, the statutory accounts must be prepared in line with UK GAAP or IFRS and lodged with Companies House before the deadline. Then there’s the monthly VAT return, PAYE submissions and corporation tax calculations, all of which need accurate data feeds from the accounting system. Regular liaison with external auditors, updating the risk register and ensuring any new regulatory guidance is reflected in policies complete the loop.

How can a controller add strategic value beyond number‑crunching?

By turning forecasts into ‘what‑if’ stories that help the board test growth scenarios before they spend a penny. They can spot cost‑leakage early, suggest pricing tweaks, and highlight which product lines deliver the best return on capital. When a controller presents a clear, data‑driven narrative, they become a trusted partner rather than a back‑office function, shaping the company’s direction.

What tools help a controller keep risk management under control?

A living risk register stored on a shared drive is the simplest yet most effective, update it after every audit, contract win or regulatory change. Monthly huddles with department heads turn the register into a conversation, not a spreadsheet. Automation rules in your ERP can flag unusual payments or sudden expense spikes, giving you a heads‑up before a problem escalates.

Where can I find the right financial controller talent for my company?

In the UK, specialised finance recruitment agencies have deep networks of candidates who understand the nuances of UK GAAP, Companies House filing and sector‑specific risk profiles. They can vet candidates for both technical proficiency and the strategic mindset you need. Partnering with a trusted recruiter also speeds up the interview process and ensures you’re meeting people who already align with your culture.

Conclusion

We've walked through the four pillars that make up financial controller responsibilities in UK businesses, from statutory reporting to risk‑management, and you’ve seen how they translate into real‑world impact.

So, what does that mean for you? It means that a controller who can blend technical rigour with strategic insight becomes the glue that keeps the board confident and the cash‑flow healthy.

Think about the last time a forecast fell short or a compliance deadline was a hair away. If you’ve got a clear process, a living risk register and a rolling cash‑flow model, those panic moments shrink dramatically.

Here’s a quick checklist to run through next week:

Is your reporting calendar pinned on the wall and synced with reminders?

Do you run a rolling forecast and stress‑test at least three scenarios each quarter?

Is your risk register a shared, living document rather than a static spreadsheet?

Are dual‑approval controls active for any payment over £5k?

If any of those boxes are empty, you’ve just spotted your next improvement opportunity.

Ready to level up? Whether you’re hunting for a controller who ticks all these boxes or you’re a finance pro looking to showcase your expertise, Get Recruited can help match the right talent to the right challenge.